the Wealthy turn off their Country..... tax ripoffs

-

-

Recently Browsing

0 members

Recently Browsing

0 members

- No registered users viewing this page.

-

Demonland Forums

Demonland Forums

-

-

Match Previews, Reports & Articles

Match Previews, Reports & Articles

THE BLOW by Whispering Jack

Narrm’s finals prospects took a crushing blow after the team’s insipid performance at Optus Stadium against a confident Waaljit Marawar in the first of its Doug Nicholls Round outings for 2024. I use the description “crushing blow” advisedly because, although the season is not yet at it’s halfway mark, the Demons have now failed abysmally in two of their games against teams currently occupying bottom eight places on the ladder. The manner in which these losing games were played out w

HALF FULL by KC from Casey

It was a case of the Casey Demons going into a game with a glass half full in their match up against the Brisbane Lions at Casey Fields on Saturday. As the list of injured and unavailable AFL and VFL listed players continues to grow and with Melbourne taking all three emergencies to Perth for the weekend on a “just in case” basis, its little brother was always destined to struggle. Casey was left with only eight AFL listed players from who to select their team but only two - an out-of-form

PREGAME: Rd 11 vs St. Kilda

The Demons return to the MCG to take on the Saints in Round 11 on the back of two straight losses in a row. With Jake Lever out with concussion who comes in and who goes out?

PODCAST: Rd 10 vs West Coast

The Demonland Podcast will air LIVE on Monday, 20th May @ 8:30pm. Join George, Binman & I as we dissect the Demons disaapoiting performance against the Eagles at Optus Stadium in Round 10. You questions and comments are a huge part of our podcast so please post anything you want to ask or say below and we'll give you a shout out on the show. If you would like to leave us a voicemail please call 03 9016 3666 and don't worry no body answers so you don't have to talk to a human.

VOTES: Rd 10 vs West Coast

Last week Captain Max Gawn consolidated his lead over reigning champion Christian Petracca in the Demonland Player of the Year Award. Steven May, Alex Neal-Bullen & Jake Lever make up the Top 5. Your votes for the loss against the Blues. 6, 5, 4, 3, 2, 1.

POSTGAME: Rd 10 vs West Coast

Many warned that this was a danger game and the Demons were totally outclassed all game by a young Eagles team at Optus Stadium in Perth as they were defeated by 35 points.

GAMEDAY: Rd 10 vs West Coast

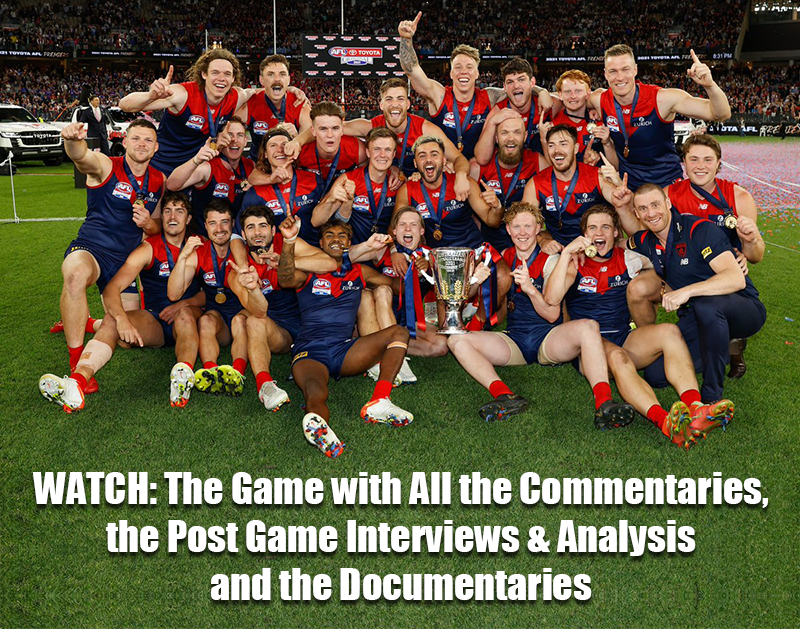

It's Game Day and the Demons have returned to the site of their drought breaking Premiership to take on the West Coast Eagles in what could very well be a danger game for Narrm at Optus Stadium. A win and a percentage boost will keep the Dees in top four contention whilst a loss will cast doubt on the Dees flag credentials and bring them back to the pack fighting for a spot in the 8 as we fast approach the halfway point of the season.

WARNING by William from Waalitj

As a long term resident of Waalitj Marawar, I am moved to warn my fellow Narrm fans that a danger game awaits. The locals are no longer the easybeats who stumbled, fumbled and bumbled their way to the good fortune of gathering the number one draft pick and a generational player in Harley Reid last year. They are definitely better than they were then. Young Harley has already proven his worth with some stellar performances for a first year kid playing among men. He’s taken hangers, k

OVER YET? by KC from Casey

The Friday evening rush hour clash of two of the VFL’s 2024 minnows, Carlton and the Casey Demons was excruciatingly painful to watch, even if it was for the most part a close encounter. I suppose that since the game had to produce a result (a tie would have done the game some justice), the four points that went to Casey with the win, were fully justified because they went to the best team. In that respect, my opinion is based on the fact that the Blues were a lopsided combination that had

-

Tell a friend

Tell a friend

.thumb.jpeg.f764daa08d98c85e545c169a6d6e9d9b.jpeg)

Recommended Posts

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.